Anyone who has bought a property in Singapore knows how complex the process can be. The challenge becomes even more arduous when you’re buying multiple properties since government taxes and duties is a whole other issue.

Some may argue that placing a property under a trust for your child will make the process much easier, but this is not a situation in which you should proceed blindly.

Property trusts can come with a wide range of advantages, disadvantages, and considerations. Most importantly, you’ll need to understand the intentions of all the people involved in the trust, especially your child. We explore the benefits and considerations of setting up a property trust for your child in this article.

What is a property trust?

A property trust is a legal arrangement where property ownership is divided into legal ownership and beneficial ownership. In this case, one person owns the property, while the other is the beneficiary.

If you were to set up a property trust for your child, they would automatically become the beneficiary owner and be counted as the legal owner.

The arrangement applies to all trusts. Here’s an example that you might be more familiar with:

As Singaporeans, our CPF accounts are statutorily established trusts. Part of our money is held by the Central Provident Fund (CPF) Board for retirement purposes.

In this case, the CPF Board acts as trustee, while Singaporeans are the beneficial owners of the accounts.

A trust is typically created by a branch of law known as equity. Each trust is built on the understanding that everyone has acted in a manner that is both just and fair. In some cases, courts reject trusts put into place due to deception, trickery, or other misdirection.

A trust usually involves three parties:

- the settlor (who puts their assets into the trust),

- the trustee (the legal owner or person managing the assets, who can also be the settlor),

- the beneficiary (the person entitled to the benefits of the assets in the trust).

In general, trust agreements for children expire when they turn 21, or when certain conditions are met in the agreement. When the trust ends, your child becomes the legal owner of the property. This means that your child is legally responsible for all payments, including taxes, mortgages and more.

Advantages of getting a property trust for your child

1. Leaving behind a legacy

As a parent, naming your children as beneficiaries in a property trust ensures your legacy will live on. It doesn’t matter how young your child is to do this. They could be as young as a year old and unaware that they own a property.

Furthermore, if anything unfortunate occurs to you, you’ll also have the guarantee that this property is something you’ve left to your children. As far as legality is concerned, your child holds ownership of the property, not you.

2. Protected in the event of bankruptcy

Having a property trust also provides your child with extra protection. If you were to declare bankruptcy years after the trust was created, your child’s ownership will remain unaffected by creditors.

While you may not be able to act as a trustee after that, a relative or trusted contact may be able to help.

3. Lower fees

The main benefit of setting up a property trust is that your fees go down significantly. This is because it includes legal fees, additional buyer’s stamp duty (ABSD), and loan tenure, all of which become increasingly expensive as you age and with every home you buy.

Learn more about ABSD and property stamp duties in Singapore here.

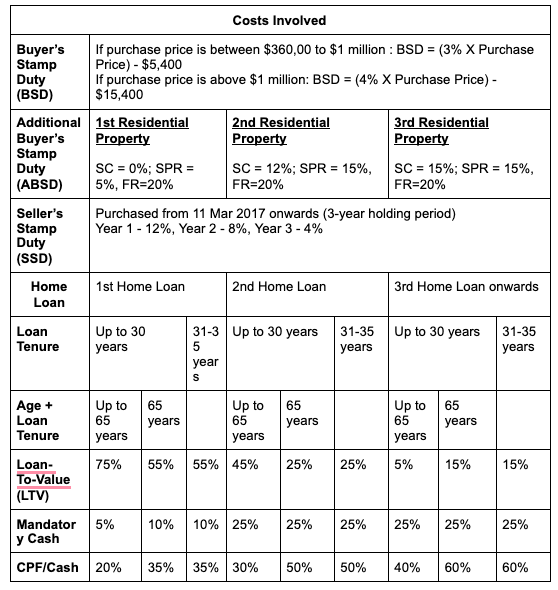

Let’s take a look at all the costs involved and how they scale over time.

As you can see, our fees and expenses will scale as time passes. So how does a property trust help mitigate this?

Your property trust may allow you to avoid paying ABSD since your child’s first home will be included and calculates based on all the homes you have already owned.

READ: How to avoid ABSD when getting a second property in Singapore

Disadvantages of getting a property trust for your child

1. Not eligible for home loan in Singapore

Since you’re buying the home under your child’s name, the trust will not be eligible for a home loan in Singapore. While you may use other resources to borrow from the bank to grant you a loan, this loan will be your responsibility – not your child’s.

This is because your child can’t sign any legal documents, given that they’re below the age

of 21 and are lacking the legal capacity.

Should you take out a home loan through a mortgage broker? Find out here.

2. Your child is subject to ABSD and other factors if they wish to purchase a home in the future

Another clear disadvantage of a property trust is that you only manage the property or assets as a trustee. Should your child decide to purchase another home once they turn 21, they will have to pay ABSD and there are other factors that will affect them for their second home.

Since your child already owns a property, they might not be able to purchase a BTO HDB flat. Even if they want to, they will need to sell the house.

When your child turns 21 and assumes legal responsibility, as your name is not in the property, the child has sole discretion to the property. So, if you want to share ownership of the family home, a property trust is entirely dependent on a stable relationship between you and your child.

3. Trusts are irrevocable

Another key element of trusts is that they’re irrevocable. Once you set up the trust, the property belongs to your child. Although very unlikely, trusts might contain a clause allowing for cancellation in rare cases.

In addition, a trustee cannot make profits from their trusteeship. Therefore, you may be sued for stealing from your child in such a circumstance unless the trust indicates that you may profit from it.

There are times, however, when the parents are not to blame. In the unlikely event that your child grows up rebellious, you have given them financial assets worth a house, which can be used irresponsibly. The fact that your child owns a home gives them leverage should they need to take out a large loan. Depending on the situation, this could be a good or a bad thing.

Where should you go for advice?

In general, you have a few options for getting advice on a property trust for your child. Different parties are likely to provide you with varying amounts and types of information.

A trust lawyer, for example, may be able to advise on the long-term effects of a trust. Taking this step will also ensure you’re prepared for any potential future event as your child ages and your financial situation changes. Your lawyer will also be able to provide you with legal clauses you might like to include in the trust to protect you and your children.

On the other hand, a trust company may be able to offer advice on more complicated aspects of setting up a trust for your child – such as what the process will involve in the years to come and how your situation may change if unfortunate events occurred.

Before committing to a significant decision such as a property trust, you may also want to consider speaking to someone who will take the time to understand your situation and life goals fully.

We, as mortgage brokers, can introduce you to property trusts and then help you find the right parties based on your situation, so speak to us today!